23XI/FRM shocked fans when it announced that if NASCAR sold the charters it held earlier this year, the team would cease operations after 2025: “This court has found that it is not economically feasible to race as an open-team for the long term… and NASCAR has not challenged that ruling on appeal.”… Full details👇

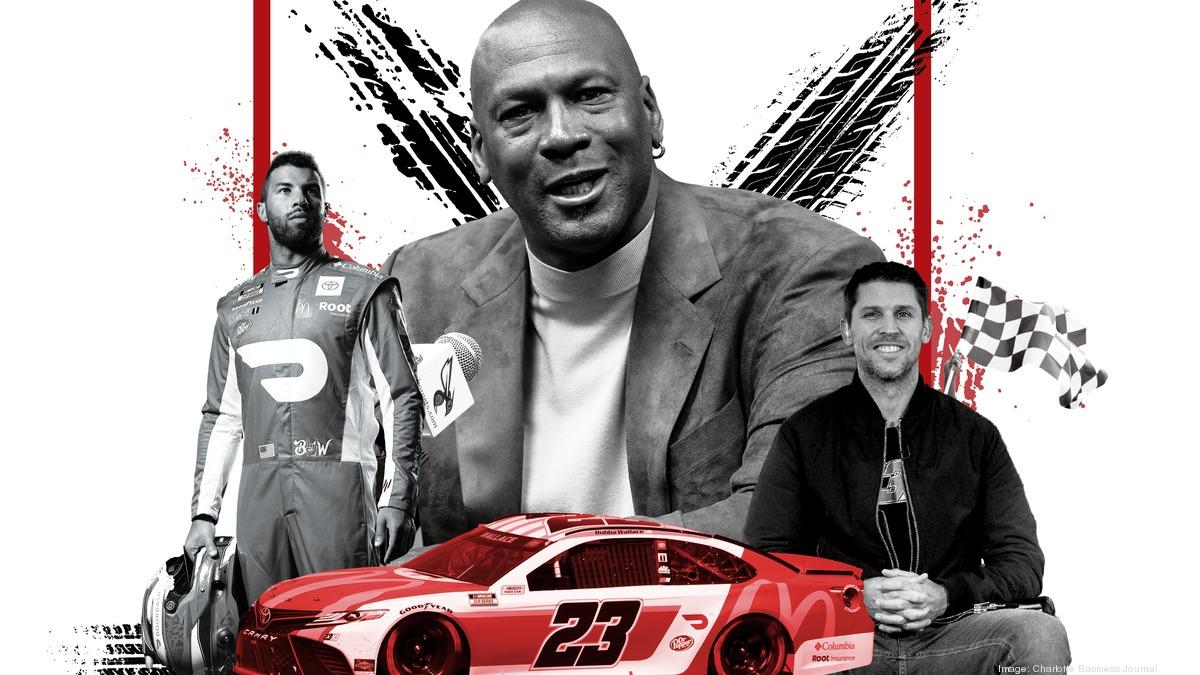

The world of NASCAR is no stranger to high-speed drama on the track, but a different kind of race is unfolding in the courtroom, one that could reshape the sport’s future. At the center of this legal showdown is 23XI Racing, co-owned by basketball legend Michael Jordan and NASCAR star Denny Hamlin, alongside Front Row Motorsports (FRM). The two teams have taken on NASCAR and its chairman, Jim France, in a bold antitrust lawsuit that has sent shockwaves through the motorsport community. With a critical court hearing set for August 28, 2025, the stakes are higher than ever, and the outcome could redefine how NASCAR operates.

The dispute began in October 2024, when 23XI Racing and FRM filed a federal antitrust lawsuit in North Carolina, accusing NASCAR of operating like a monopoly. The teams argue that the charter system, which guarantees starting spots and prize money for select teams, unfairly restricts competition by binding teams to NASCAR’s tracks and suppliers. Unlike 13 other teams that signed new charter agreements in September 2024, 23XI and FRM refused, citing unfair terms. Michael Jordan himself didn’t mince words, stating, “The way NASCAR is run today is unfair to teams, drivers, sponsors, and fans.” This sentiment, shared in a statement to ESPN, underscores the teams’ belief that NASCAR’s business model stifles innovation and fairness in the sport.

The charter system lies at the heart of this conflict. Charters, akin to franchises in other sports, ensure teams a guaranteed spot in each race and a significant share of the purse. However, they come with conditions, including a release clause that prevents teams from suing NASCAR. 23XI and FRM contend this clause is anti-competitive, a claim that initially gained traction when a federal judge granted a temporary injunction in December 2024, allowing both teams to race as chartered teams in 2025 and even acquire additional charters from the defunct Stewart-Haas Racing. This gave each team three charters, securing their immediate future on the track.

However, the tide turned on June 5, 2025, when a three-judge panel from the U.S. Court of Appeals for the Fourth Circuit reversed the injunction. The panel ruled that NASCAR’s release clause did not violate antitrust laws, stating, “We have found no support for the proposition that a business entity violates the antitrust laws by requiring a prospective participant to give a release for past conduct as a condition for doing business.” This decision, reported by NBC Chicago, threatens to strip 23XI and FRM of their chartered status, forcing them to compete as “open” teams. Open teams must qualify for races based on speed and receive a smaller share of prize money, a scenario that could jeopardize their financial stability and competitive edge.

The teams wasted no time responding. By June 20, 2025, they filed for a rehearing with the Fourth Circuit, requesting either the same panel or the full court to reconsider. Veteran NASCAR reporter Bob Pockrass noted on X, “No timeline for the U.S. Court of Appeals to decide whether there will be a rehearing with all the 4th circuit judges. Until then, they remain chartered. If they decide not to hear it, 23XI/FRM could lose charters 7 days after that decision.” This filing has delayed any immediate change to their status, but the uncertainty looms large as the August 28 hearing approaches.

The legal battle has also taken a personal turn. NASCAR’s countersuit, filed earlier this year, named Michael Jordan’s longtime business partner Curtis Polk as a defendant, accusing him, 23XI, and FRM of “orchestrating anticompetitive collective conduct.” This escalation, reported by Jeff Gluck on X, highlights NASCAR’s aggressive stance in defending its charter system. NASCAR argues that it pays teams a higher percentage of revenue than even Formula 1, a claim made in a court filing shared by Gluck, which stated, “NASCAR pays teams more than even Formula 1 as a percentage of profit.” The sanctioning body also demands that 23XI and FRM repay funds received under the earlier injunction, adding financial pressure to the legal fight.

For 23XI Racing, the stakes extend beyond the courtroom. The team’s drivers, including Tyler Reddick, last year’s regular-season champion, and Bubba Wallace, one of NASCAR’s most recognizable figures, face an uncertain future. Reddick’s contract reportedly hinges on 23XI maintaining chartered status, and losing it could make him a free agent. Wallace, reflecting on the situation, expressed a relaxed mindset heading into a recent race, saying, “I got nothing to stress about.” His confidence, noted on 23XI’s official website, suggests the team remains focused on performing despite the off-track turmoil.

The teams’ demands are ambitious. Their attorney, Jeffrey Kessler, outlined potential changes if they win, including forcing NASCAR to sell off its 20 owned racetracks, allowing teams to use Next Gen cars in non-NASCAR races, and securing long-term charter status. Kessler emphasized, “We remain confident in our case and committed to racing for the entirety of this season as we continue our fight to create a fair and just economic system for stock car racing.” This vision, reported by FOX Sports, aims to dismantle what the teams see as NASCAR’s monopolistic control over the sport.

NASCAR, however, remains steadfast. The organization argues that a July 2025 rule change already guarantees starting spots for all teams in 2025, mitigating the teams’ claims of harm. It also points to interest from other Cup teams, racing outfits, and outside investors eager to buy the charters if 23XI and FRM lose them. Pockrass reported that any charter sale would require a 30-day bidding process, starting immediately to ensure new owners are ready by October 1 for the 2026 season. This timeline adds urgency to the August 28 hearing, which could determine whether 23XI and FRM retain their charters or face a precarious future.

The broader implications of this lawsuit are profound. A victory for 23XI and FRM could force NASCAR to overhaul its business model, potentially opening the sport to more competition and innovation. Conversely, a win for NASCAR could solidify its control over the charter system, leaving dissenting teams vulnerable. U.S. District Court Judge Kenneth Bell, commenting on the case, warned, “It’s hard to picture a winner in the legal battle between NASCAR and two teams if they don’t settle,” a sentiment reported by ESPN that underscores the high stakes for both sides.

As the August 28 hearing looms, the NASCAR community watches closely. Will Michael Jordan’s 23XI Racing and Front Row Motorsports secure their place in the sport, or will NASCAR’s grip on the charter system prevail? The outcome could alter the trajectory of stock car racing, affecting teams, drivers, and fans alike. For now, the legal race is as gripping as any on the track, with the finish line still out of sight.