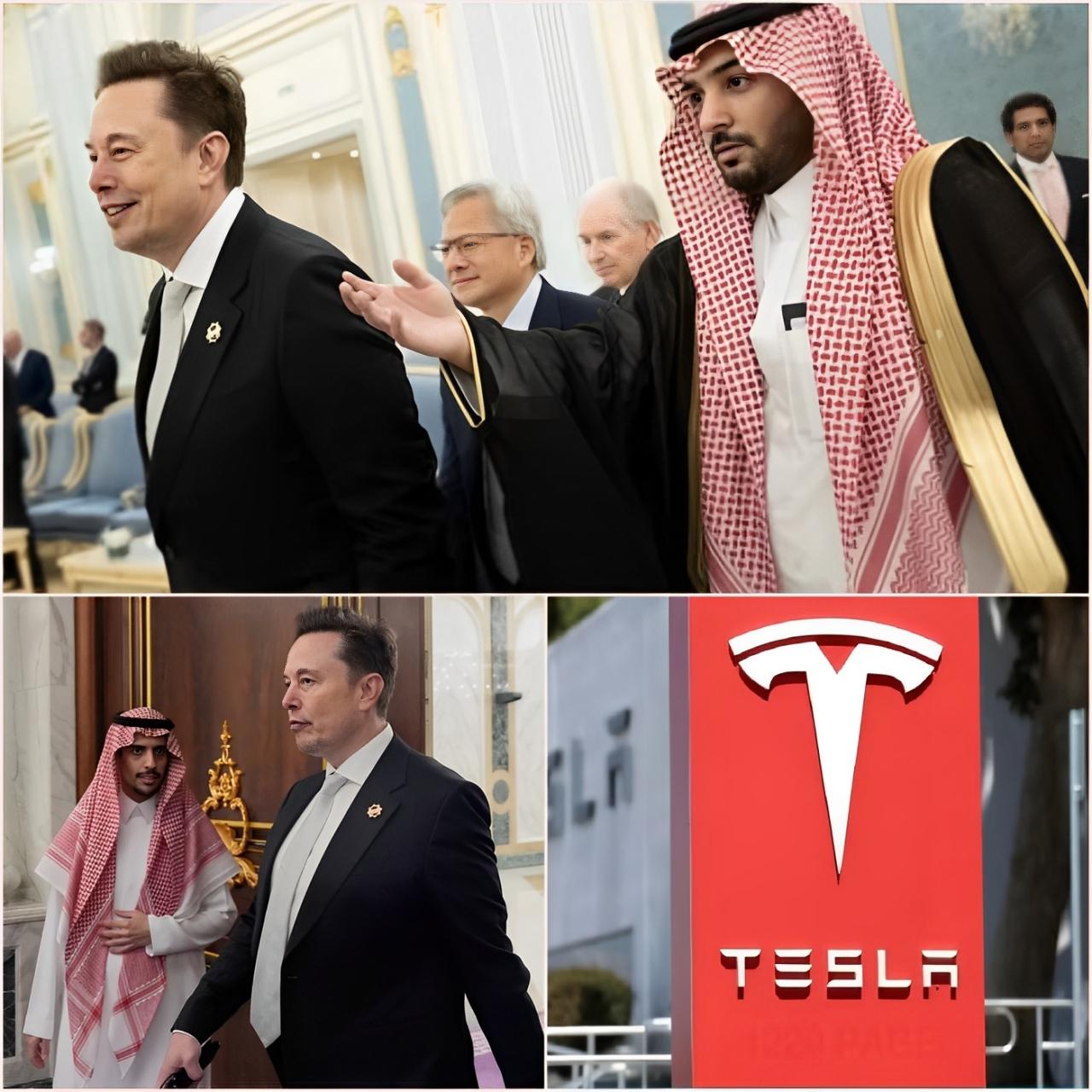

An event of historic proportions has shaken the business and geopolitical worlds. Elon Musk, CEO of Tesla and SpaceX, and Mohammed bin Salman, the crown prince of Saudi Arabia, have officially closed a strategic agreement of such massive value that it immediately pushed Tesla’s market capitalization past the $1 trillion mark.

An unprecedented strategic and energy agreement

According to sources close to the deal, it includes the construction of a Tesla Gigafactory in the futuristic city of Neom, in the heart of the Saudi desert, as well as a long-term investment by the Saudi Public Investment Fund (PIF) in clean technologies, next-generation batteries, and exclusive access to strategic minerals.

“This isn’t just a business deal, it’s the union of two visions of the future: Elon Musk’s vision of a sustainable planet, and MBS’s vision of modernizing the Gulf,” said a Bloomberg analyst.

The PIF is estimated to invest more than $50 billion in Tesla over the next 10 years, positioning the kingdom as a key partner in the global expansion of electric mobility.

Explosive reaction in the markets

The news was officially announced during a conference in Riyadh and generated an immediate reaction on Wall Street. In just a few hours:

-

Tesla shares rose 13%.

-

Trading volume increased fivefold.

-

The company surpassed the symbolic barrier of a trillion dollars in market capitalization.

“It’s a turning point in the relationship between traditional energy resources and new clean technologies,” commented the Financial Times.

An alliance of convenience or shared vision?

Although the agreement surprised many, it makes strategic sense. Musk has reiterated his need to secure essential resources for his electric batteries (such as lithium and nickel), while Saudi Arabia, through its “Vision 2030” plan, seeks to diversify its economy beyond oil.

“Tesla gains autonomy and access to strategic minerals; Saudi Arabia positions itself as a leader in green innovation,” an insider explained.

The agreement also includes joint research and production projects, and the first Tesla vehicle manufactured in Saudi Arabia is expected to be available in 2027.

Criticism from activists and analysts

Despite market enthusiasm, the agreement has drawn strong criticism. Human rights activists question the collaboration with a regime accused of censorship, repression, and political violence.

On X (formerly Twitter), many users recalled the case of journalist Jamal Khashoggi and accused Musk of “ethical hypocrisy.”

“Musk preaches freedom but makes deals with dictatorships for money,” wrote one user with thousands of followers.

Alarms have also been raised about working conditions at potential Saudi production sites and the environmental impact of mining operations.

Future and projections

With this agreement, Tesla could strengthen its global leadership in the electric vehicle market, especially in regions with extreme climates like the Middle East and Africa. The plan includes models specifically designed for high temperatures and sandy conditions, representing a new line of innovation.

Conclusion

The alliance between Elon Musk and the Saudi crown prince marks a new chapter in the global economy. Beyond money and technology, this pact raises profound questions about values, ethics, and the future of global sustainability.

As Tesla celebrates its historic leap, the world is watching closely what this agreement represents: a new era of power, investment, and influence.