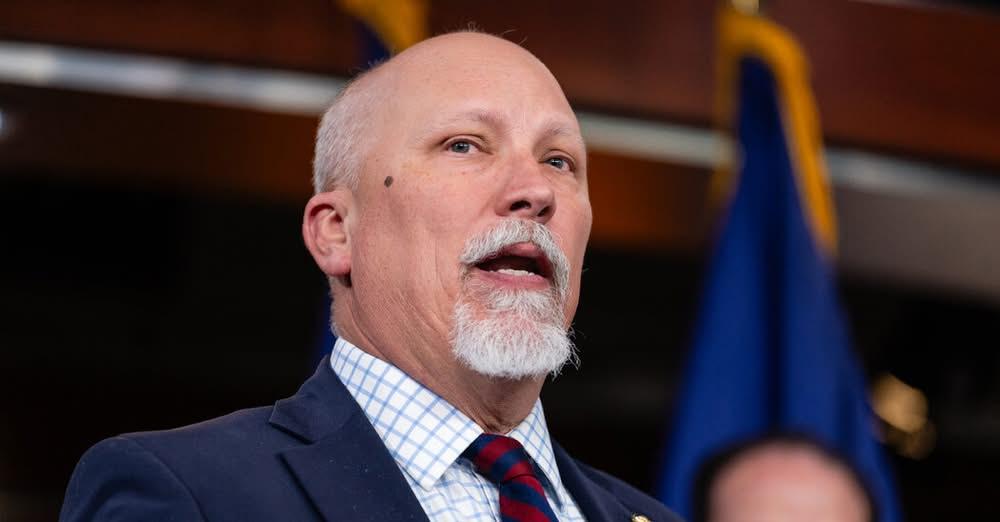

On the night of May 18, 2025, the House Budget Committee approved President Donald Trump’s ambitious “One Big Beautiful Bill,” a sprawling tax and spending package, after a weekend of intense negotiations with fiscal conservatives. The vote, which ended at 17-16-4, marked a critical step forward for Trump’s domestic agenda but revealed lingering tensions within the Republican Party as four hard-liners—Reps. Chip Roy, Ralph Norman, Andrew Clyde, and Josh Brecheen—voted “present” rather than in full support. As of 11:20 AM +07 on Monday, May 19, 2025, the bill now heads toward a potential House floor vote by Memorial Day, though significant challenges remain.

The bill, officially named the “One Big Beautiful Bill Act,” extends Trump’s 2017 tax cuts, adds new tax breaks like no taxes on tips, overtime pay, and some auto loans, and boosts the standard deduction to $32,000 for joint filers. It also allocates $350 billion for deportation efforts and Pentagon funding, while slashing over $1 trillion from healthcare and food assistance programs through measures like Medicaid work requirements. However, conservatives have pushed for deeper cuts, including an immediate repeal of Biden-era green energy tax credits, a demand GOP leaders have resisted, opting for a gradual phase-out. This compromise led to the weekend’s breakthrough, with Speaker Mike Johnson making “minor modifications” to appease the holdouts, though they remain unsatisfied.

The approval follows a dramatic setback on May 16, when the same committee failed to advance the bill due to conservative opposition, frustrated by its failure to curb the national debt—already a concern after Moody’s downgraded the U.S. credit rating on May 16, citing the bill’s potential to balloon the debt further. The weekend negotiations saw Johnson and White House officials concede to accelerating Medicaid work requirements and discussing the removal of state waivers, though hard-liners continue to demand more aggressive cuts to health and environmental programs. Posts on X reflect GOP optimism, with users noting Johnson’s surprise appearance at the late-night session to rally support, but also highlight conservative skepticism about the bill’s fiscal impact.

The bill’s passage through the committee is a win for Trump, who returned from a Middle East trip on May 17 and urged GOP unity, posting on X that Republicans “MUST UNITE behind, ‘THE ONE, BIG BEAUTIFUL BILL.’” However, the “present” votes signal trouble ahead. The narrow House majority means Johnson must balance conservative demands with moderates’ concerns, especially from high-tax states pushing for a deeper state-and-local-tax (SALT) deduction—capped at $40,000 for individuals and $80,000 for married couples in the current draft. Democrats, meanwhile, have seized on the GOP infighting, with Rep. Brendan Boyle mocking the divide during the markup.

The next steps are daunting. The bill must pass the House Rules Committee and a full floor vote, targeted for Thursday before the Memorial Day recess. Senate Republicans, operating on a slower timeline with a July 4 goal, are already signaling changes, particularly on Medicaid and food aid reforms, which could complicate reconciliation. The bill’s $5 trillion in tax cuts, offset by cuts to social programs, has drawn criticism for its economic risks, especially after recent market chaos and Walmart’s price hike announcement tied to Trump’s tariffs. Trump’s team, led by figures like Scott Bessent, insists the plan will grow GDP faster than debt, but the Moody’s downgrade casts a shadow.

Public sentiment, as seen on X, is mixed—some celebrate the bill as a fulfillment of Trump’s campaign promises, while others warn of its impact on vulnerable populations. The bill’s fate hinges on GOP unity, Trump’s dealmaking, and potential Senate revisions, making its journey far from certain. As the House prepares for the next vote, the nation watches whether Trump’s vision will solidify or unravel under the weight of internal divisions.