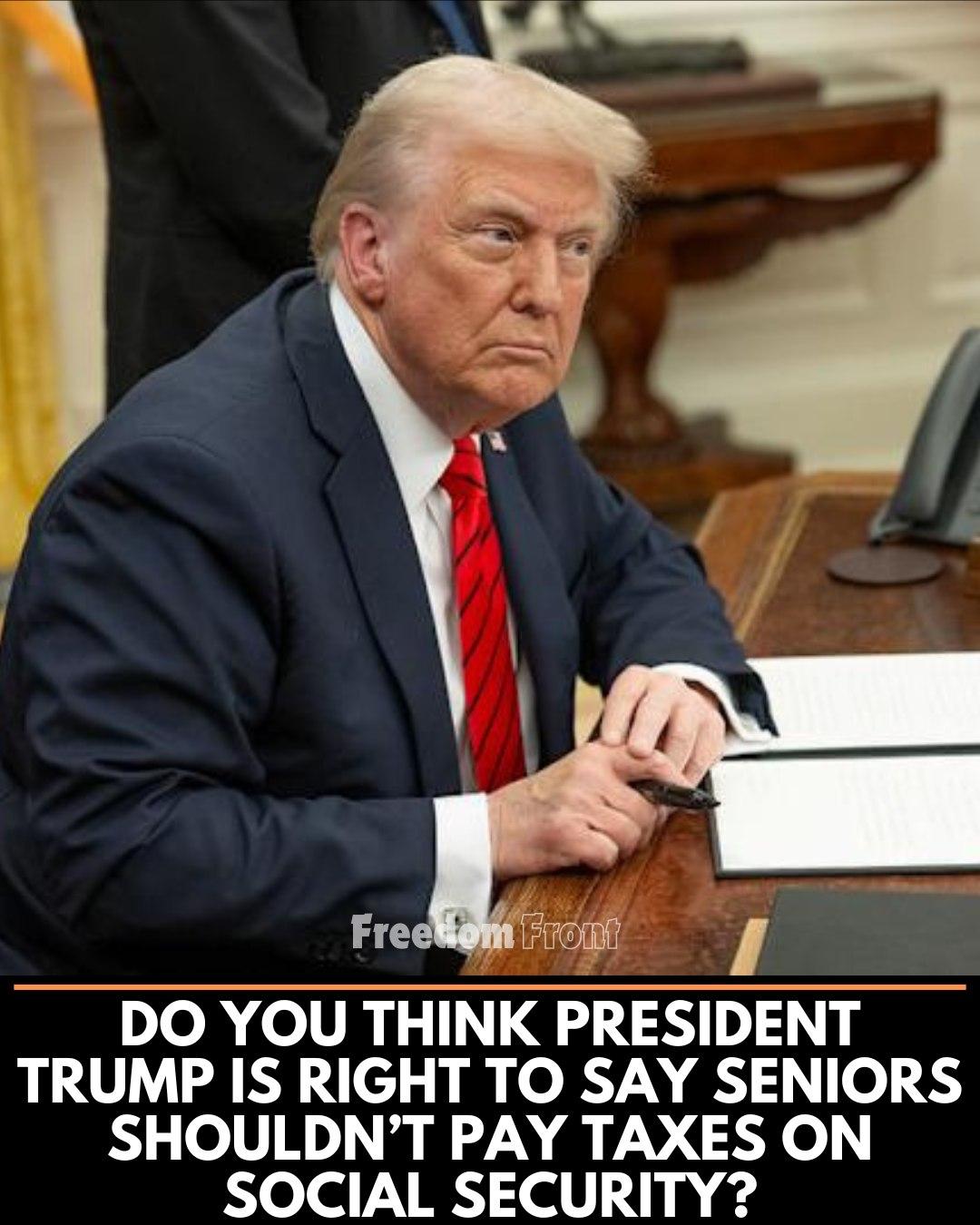

Trump Sparks Debate: Should Seniors Be Exempt from Social Security Taxes?BREAKING NEWS👇👇:

In a recent statement that has ignited fierce debate, former President Donald Trump suggested that seniors should not have to pay taxes on their Social Security benefits. The proposal, which has gained traction among conservative circles, aims to provide financial relief to retirees who rely heavily on these funds. Trump argues that taxing Social Security is an unfair burden on the elderly, many of whom live on fixed incomes and struggle to make ends meet amid rising inflation and healthcare costs.

“These are the people who built our country,” Trump reportedly said at a rally. “They’ve paid taxes their whole lives—why are we taxing their retirement? It’s a disgrace!” Supporters of the idea, including some Republican lawmakers, claim that eliminating this tax could boost seniors’ disposable income, allowing them to afford necessities without dipping into savings. They also argue that it would stimulate local economies, as seniors would likely spend more on goods and services.

However, critics are quick to point out the potential downsides. Economists warn that removing taxes on Social Security could strain the program’s already fragile funding. The Social Security Trust Fund is projected to face depletion by 2035, and reducing tax revenue might accelerate this timeline, potentially leading to benefit cuts for future generations. Democrats, in particular, have slammed the proposal as a political stunt, accusing Trump of pandering to older voters ahead of elections. “This isn’t about helping seniors—it’s about buying votes,” one Democratic strategist remarked.

The debate has also sparked conversations about fairness. Some argue that wealthy seniors, who often receive additional income from investments, shouldn’t get the same tax break as those in need. Others believe the tax relief should be means-tested to ensure it benefits the most vulnerable. Meanwhile, Trump’s base remains steadfast, with many taking to social media to voice their support, calling the proposal a “game-changer” for retirees.

As the 2025 election cycle heats up, this issue is likely to remain a hot topic. Will Trump’s proposal gain enough momentum to become policy, or will it fizzle out under scrutiny? Only time will tell, but one thing is clear: the question of taxing Social Security benefits has struck a nerve with Americans on both sides of the aisle.