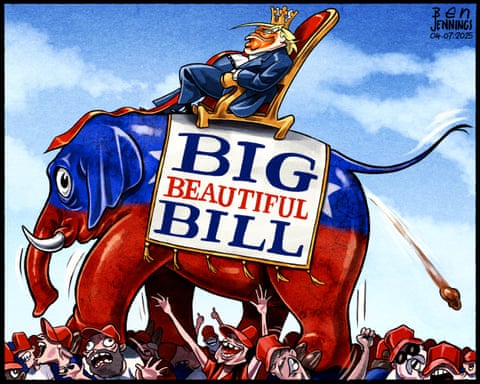

Former President Donald Trump’s proposed “big beautiful bill,” a sweeping tax reform package, has drawn intense scrutiny for its projected $3.3 trillion cost over the next decade. Critics argue this translates to approximately $903 million per day, a burden they claim will disproportionately fall on the poorest Americans while delivering substantial tax cuts to billionaires and corporations. The plan, widely discussed on platforms like X, has reignited debates over economic inequality, with detractors labeling it a wealth transfer from the working class to the ultra-rich. Supporters, however, contend it will stimulate economic growth and benefit all Americans.

The bill’s fiscal impact, as estimated by independent analysts, stems largely from extending and expanding tax cuts initially introduced during Trump’s presidency. These include reductions in corporate tax rates and benefits for high-income earners, such as eliminating caps on deductions for pass-through businesses. According to the Congressional Budget Office, nearly 60% of the tax benefits would go to the top 1% of earners, while low-income households face increased financial strain due to potential cuts in social programs to offset the deficit. One X post summarized the sentiment: “$903M a day to make billionaires richer while my rent keeps climbing? Thanks, Trump.”

Critics highlight the regressive nature of the plan, arguing that the poorest Americans, who rely on programs like Medicaid and food assistance, will bear the brunt of any budget cuts needed to fund the $3.3 trillion shortfall. The Tax Policy Center estimates that households earning less than $50,000 annually could see their effective tax rates rise indirectly through reduced public services. Meanwhile, billionaires and corporations stand to gain significantly, with some estimates suggesting a single billionaire could save millions annually in taxes. This disparity has fueled accusations that the bill prioritizes the wealthy over the working class.

Supporters of the bill argue that tax cuts for high earners and businesses will drive investment, job creation, and economic growth, ultimately benefiting all Americans. They point to the 2017 Tax Cuts and Jobs Act, which they claim boosted GDP and employment, though studies show mixed results, with much of the corporate tax savings used for stock buybacks rather than wage increases. On X, some users defend the plan, with one stating, “Lower taxes mean more jobs. Trump’s bill will get the economy roaring again.” However, economists warn that the $3.3 trillion cost could balloon the national debt, potentially leading to higher interest rates and inflation, which would hit low-income families hardest.

The debate over the bill underscores a broader divide over economic priorities. While Trump frames it as a catalyst for prosperity, opponents see it as a handout to the wealthy, exacerbating inequality. With public discourse on X reflecting deep skepticism, the bill’s passage remains uncertain. Its long-term impact on the economy and the lives of everyday Americans will depend on how Congress navigates the trade-offs between growth, debt, and fairness in an already polarized landscape.