Tesla, once the undisputed titan of the electric vehicle (EV) industry, is now facing an unprecedented crisis. The company’s sales in the first quarter of 2025 fell by a staggering 13%, with only 336,681 vehicles shipped globally compared to 386,810 a year earlier. This was Tesla’s weakest performance in nearly three years, with more than 35,000 units less than analysts’ expectations.

The fallout was immediate: Tesla’s market valuation plummeted by $100 billion by early 2025, with shares down more than 7% in after-hours trading. What was once a symbol of innovation now faces declining demand, stiff competition, and a growing backlash against CEO Elon Musk’s polarizing personality.

The numbers paint a grim picture. Tesla’s drop in deliveries — down nearly 50,000 units from last year — reflects deeper problems. In Europe, sales have fallen for three straight months in key markets like France and Sweden, while in China, Tesla has lost ground to local rival BYD. Analysts predict BYD could eclipse Tesla’s global EV market share in 2025, coming in at 15.7% versus Tesla’s 15.3%.

The shift underscores the growing threat from competitors offering cheaper, more innovative alternatives. “The brand crisis is undeniable,” said Dan Ives of Wedbush Securities, a longtime Tesla backer. “These delivery numbers signal a fundamental strategic failure.”

Much of Tesla’s problems are tied to Musk. His outspoken political positions — particularly his alignment with President Trump and controversial ties to far-right groups in Europe — have alienated a significant portion of Tesla’s liberal and green customer base. Protests have erupted outside showrooms, and vandalism of Tesla vehicles and charging stations has skyrocketed.

“The Tesla brand is no longer just a technology thing; it’s a political catalyst,” noted Thomas Martin of Globalt Investments. This shift has tangible consequences, threatening Tesla’s appeal in EV strongholds like Europe and elsewhere.

Adding to the chaos are operational missteps. Tesla has banked on a refreshed Model Y to boost demand, but production delays as it retools global factories caused costly downtime in the first quarter.

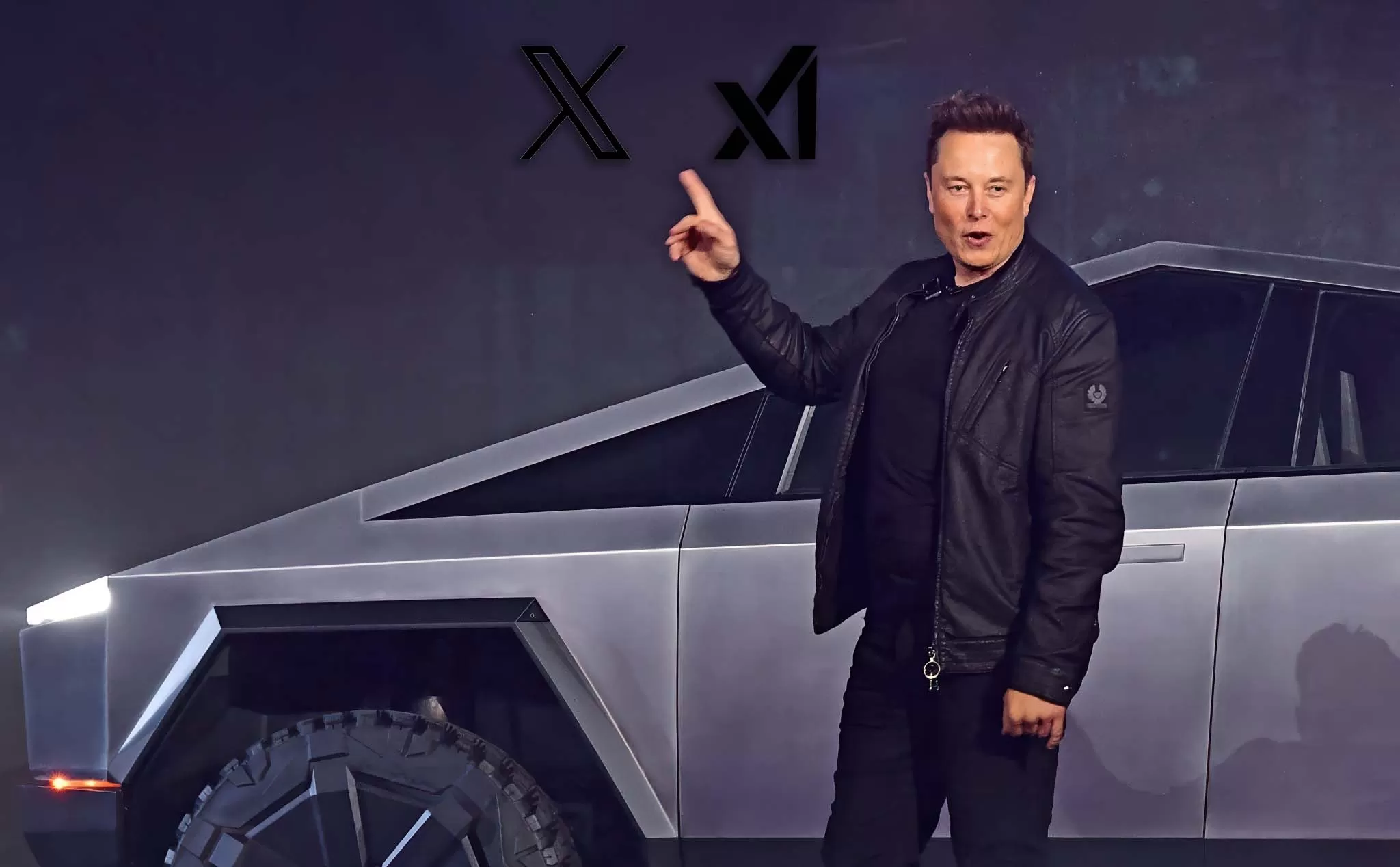

The Cybertruck, another much-hyped proposition, has foundered amid criticism for its design and price, while Musk’s promised affordable electric vehicle remains elusive. After forecasting 20-30% sales growth for 2025, Musk dodged such bold claims in his January earnings conference call, offering only vague assurances of a recovery. Investors are now waiting for the April 22 first-quarter earnings conference call for concrete answers.

Musk’s political intrigues add to the tension. His $20 million bid to back a conservative candidate in the Wisconsin Supreme Court race backfired, sparking outrage and reinforcing perceptions of outrage. Rumors that Musk might step down as a Trump adviser briefly sent shares higher, but the White House has denied the speculation.

With his attention divided between Tesla, SpaceX, X and politics, critics question whether Musk can steer Tesla through this storm. New U.S. tariffs on imported components — despite Tesla’s domestic production — further threaten margins, giving rivals with localized supply chains an edge.

Tesla’s valuation has fallen 45% since December, a far cry from its days as a tech icon. As competition intensifies and Musk’s personal brand fades, Tesla must redefine itself. The upcoming earnings conference call will test whether Musk can turn things around or whether Tesla’s once-iron legacy is finally fading.