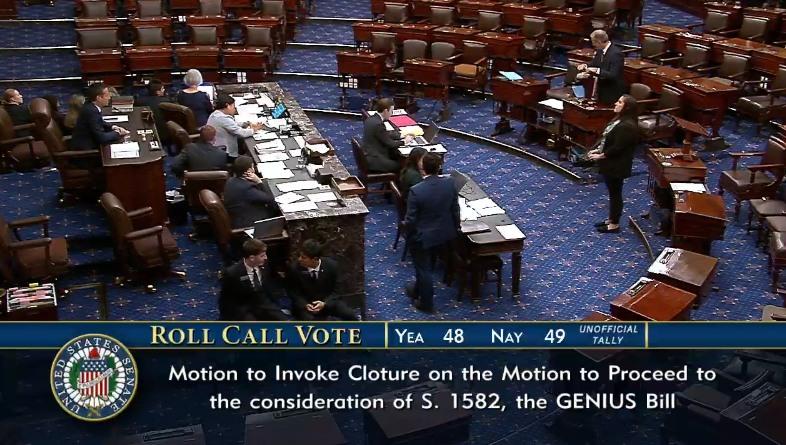

The United States Senate has narrowly rejected advancing a piece of pro-cryptocurrency legislation, with a vote of 48-49, dealing a blow to advocates of digital currencies, including Scott Bessent, President Trump’s nominee for Treasury Secretary. The bill, which aimed to create a more favorable regulatory environment for cryptocurrencies, was seen as a critical step toward integrating digital assets into the broader financial system. Its rejection underscores the ongoing divide in Washington over how to approach the rapidly evolving crypto industry.

Proponents of the legislation argued that it would have provided clarity for businesses and investors operating in the crypto space. The bill included provisions to streamline regulations, reduce compliance burdens for smaller firms, and establish a framework for digital asset taxation. Supporters, including Bessent, emphasized that such measures were necessary to maintain U.S. competitiveness in the global financial landscape, where countries like Singapore and Switzerland have already embraced crypto-friendly policies. Bessent, a hedge fund veteran with a track record of advocating for innovation in finance, had publicly endorsed the bill as a way to unlock economic potential and foster technological advancement.

Opponents, however, raised concerns about the risks associated with cryptocurrencies, including their potential use in illicit activities, market volatility, and lack of consumer protections. Several senators argued that the bill did not go far enough to address these issues, citing recent high-profile crypto scams and market crashes that left investors with significant losses. Critics also pointed to the environmental impact of crypto mining, which consumes vast amounts of energy, as a reason to proceed cautiously. The narrow margin of the vote reflects the contentious nature of the debate, with some lawmakers expressing openness to future legislation but calling for stronger safeguards.

The rejection comes at a time when the crypto industry is gaining mainstream traction, with major financial institutions increasingly investing in blockchain technology and digital assets. Public interest in cryptocurrencies has surged, driven by rising prices and growing acceptance among retailers and payment platforms. However, regulatory uncertainty continues to loom large, with agencies like the Securities and Exchange Commission and the Commodity Futures Trading Commission yet to establish clear guidelines for the industry.

For Bessent, the Senate’s decision is a setback but unlikely to deter his broader push for economic policies that embrace innovation. As he prepares for his role as Treasury Secretary, he has signaled a commitment to working with lawmakers to craft bipartisan solutions that balance growth with oversight. Meanwhile, crypto advocates are regrouping, with industry leaders vowing to continue lobbying for legislation that supports digital currencies while addressing legitimate concerns.

The Senate’s vote highlights the challenges of legislating in a rapidly changing technological landscape. As cryptocurrencies become more entrenched in the global economy, the pressure to find a regulatory middle ground will only intensify. For now, the crypto industry remains in limbo, awaiting the next move from policymakers in Washington.