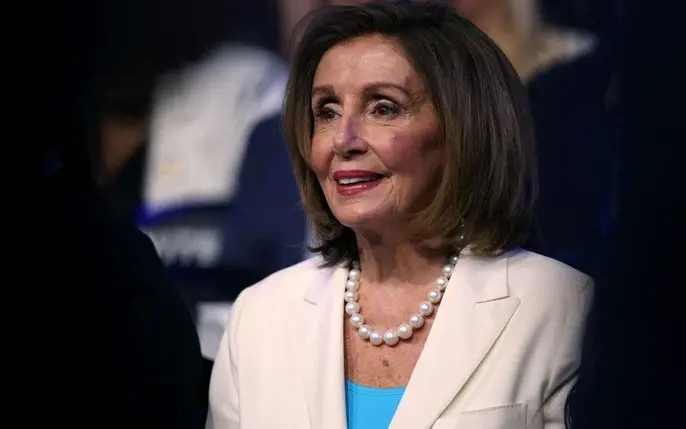

Former House Speaker Nancy Pelosi has once again found herself at the center of controversy, facing renewed allegations of insider trading due to her husband Paul Pelosi’s highly profitable stock trades. The accusations, which have persisted for over a decade, stem from the couple’s remarkable success in the stock market, raising questions about whether privileged information from Pelosi’s political role has fueled their financial gains. With an estimated net worth of $264 million to $413 million, despite a congressional salary of $174,000, the Pelosis’ wealth has drawn intense scrutiny, sparking debates about ethics, transparency, and the need for reform in congressional stock trading.

The controversy first gained traction in 2011 when a 60 Minutes report highlighted how members of Congress, including Pelosi, might profit from non-public information. A notable example was the Pelosis’ 2008 purchase of 5,000 Visa shares at the IPO price of $44, just as Congress considered legislation that could have impacted credit card companies. Days later, the stock surged to $64, yielding significant profits, while the proposed bill stalled. Although Pelosi denied any wrongdoing, the optics fueled public outrage and led to the passage of the STOCK Act in 2012, which aimed to curb insider trading by requiring lawmakers to disclose trades within 45 days. However, critics argue the law’s $200 fine for violations is insufficient for wealthy politicians.

Recent events have reignited the debate. In July 2025, Paul Pelosi sold 2,000 Visa shares worth over $500,000, weeks before a Department of Justice antitrust lawsuit against the company was announced on September 24. The timing raised suspicions, as did earlier trades like the 2020 purchase of Tesla call options before a Biden administration policy boosted electric vehicle stocks, or the 2021 Microsoft investment preceding a $22 billion government contract. These trades, often yielding millions in profits, have led critics, including former President Donald Trump, to accuse Pelosi of leveraging insider knowledge. Trump, in a July 2025 Truth Social post, called her a “disgusting degenerate” and demanded an investigation, claiming her returns outpace Wall Street’s top hedge funds.

Pelosi has consistently dismissed these allegations as “ridiculous,” emphasizing that her husband’s investments are independent of her legislative duties. During a heated CNN interview with Jake Tapper in July 2025, she deflected questions about Trump’s accusations, insisting the discussion focus on Medicaid’s 60th anniversary. She reiterated her support for the HONEST Act, a bipartisan bill introduced by Senator Josh Hawley to ban stock trading by Congress, the president, and vice president. Originally named the PELOSI Act—a jab at her—the legislation reflects growing public frustration with lawmakers’ financial activities. Pelosi’s endorsement of the ban, a shift from her 2021 defense of congressional trading as part of a “free market economy,” suggests mounting pressure to address the issue.

Social media has amplified the controversy, with users on platforms like X labeling Pelosi’s wealth as evidence of corruption. Posts have called her the “queen of investing,” with some joking about her “psychic” market timing. The “Pelosi Effect” has even inspired financial products like the Unusual Whales Democratic ETF (NANC), which mimics Democratic lawmakers’ trades and outperformed the S&P 500 in its first year. Critics argue that such public fascination underscores a deeper issue: the perception that political power enables financial gain. Comments on X range from demands for investigations to defenses of Pelosi’s long-term investment strategy, reflecting polarized views.

Advocates for reform argue that even the appearance of impropriety undermines trust in government. The HONEST Act’s narrow 8-7 Senate committee vote in July 2025, supported by Democrats and Hawley, signals momentum for change, though its passage remains uncertain. Pelosi’s wealth, built through tech stocks like Apple, Amazon, and Alphabet, continues to fuel calls for stricter regulations. While no concrete evidence of illegal insider trading has emerged, the consistent timing of the Pelosis’ trades with legislative or regulatory events keeps the allegations alive. As public scrutiny intensifies, the debate over congressional stock trading is likely to shape future reforms, with Pelosi’s financial legacy at its core.