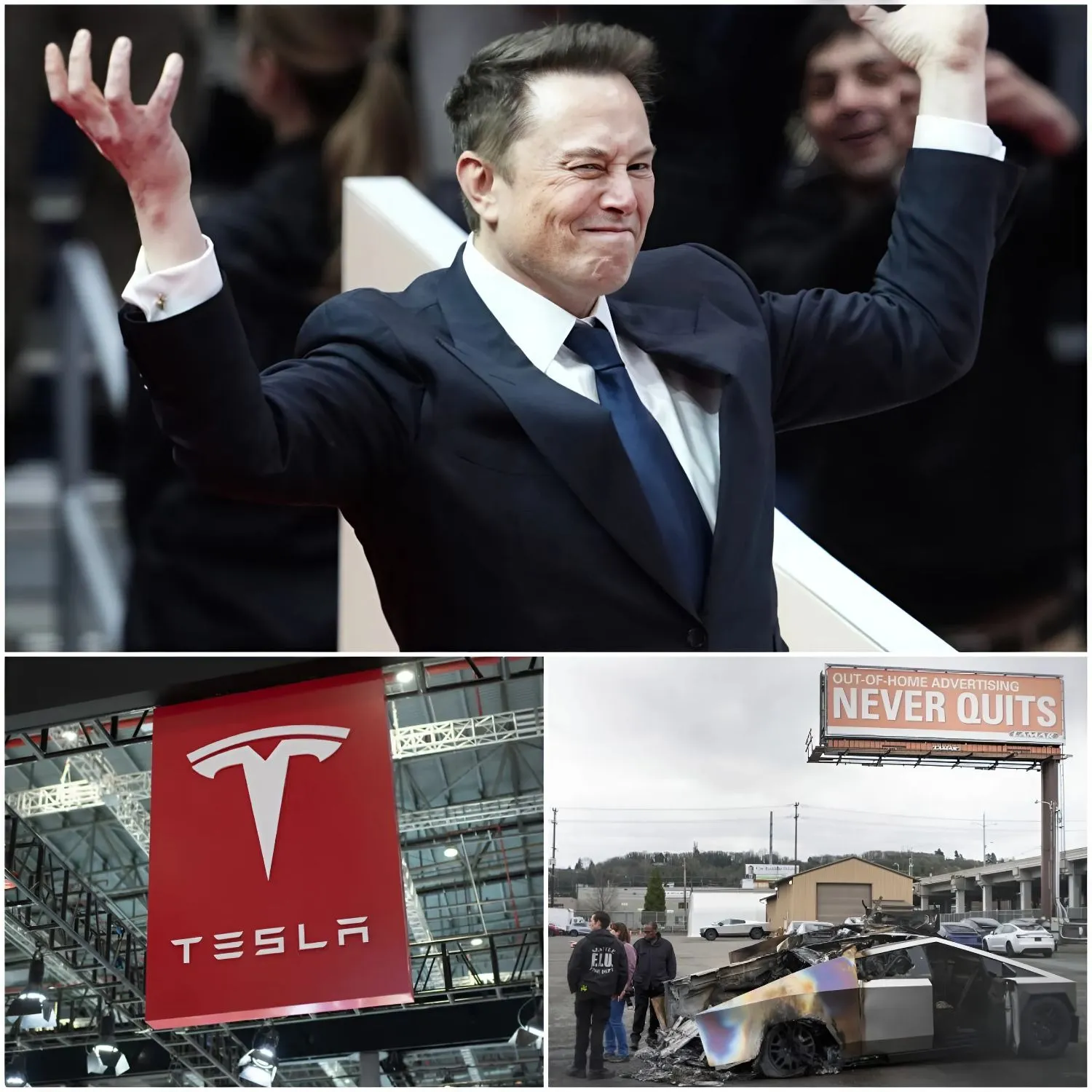

Just five minutes ago, the financial world was rocked by a shocking revelation: $44 billion vanished in an instant, leaving Elon Musk and his empire to deal with the consequences of a sudden and unexpected crisis. The news made the rounds in the global media, surprising investors, analysts and fans. According to initial reports, the huge financial loss was linked to a sharp decline in the share price of one or more of Musk’s major companies, probably related to Tesla or X (formerly Twitter).

The cause of the crash is still under investigation, but sources familiar with the matter suggest it may have been a combination of sudden market volatility, regulatory concerns, and investor panic following a leak of sensitive internal information. The domino effect was immediately felt across global markets, triggering automated selling and fueling further declines in technology and related innovation stocks.

Elon Musk, known for his usually composed public demeanor, was visibly shaken as he addressed the press and his social media followers. “This is truly incredible,” Musk wrote in a short but impactful message on X. “We are assessing the situation and working around the clock to understand what happened and how to fix it.” The message, though brief, conveyed a level of urgency and concern rarely seen from the billionaire entrepreneur.

Analysts have been quick to weigh in on the potential long-term implications. Some say the crash could mark one of the most significant setbacks in Musk’s career, threatening to derail some of his ambitious plans for space travel, artificial intelligence, or social media reform. Others say it could simply be a temporary setback for a man known for bouncing back from adversity with unprecedented speed and innovation.

Investors, on the other hand, have reacted with mixed emotions. While some are quickly selling shares to avoid further losses, others are staying put, convinced of Musk’s resilience and long-term vision. Online forums and trading platforms are currently awash with speculation, panic, and support in equal measure, as the world awaits more clarity on the exact causes of the financial disaster.

Critics have also emerged, suggesting that Musk’s controversial decisions in recent months — including abrupt management changes, bold product launches and divisive tweets — may have contributed to undermining investor confidence. “When you play with fire, sometimes you get burned,” one analyst noted, noting that innovation without stability can lead to unpredictable outcomes.

Despite the chaos, Musk’s loyal supporters continue to rally behind him. Hashtags like #StandWithElon and #MuskStrong are already trending, proving that for many, Musk remains a visionary leader whose bold moves are worth the risk.

As the investigation continues and financial experts dig deeper into the root cause of this $44 billion disappearance, one thing is certain: The business world will be watching Musk’s next move with great attention. Only time will tell whether this crisis marks a turning point or just another dramatic chapter in the life of one of the world’s most unpredictable billionaires.