Alpine F1 Crisis: Renault’s Potential Sale and Colapinto’s Uncertain Future

The Formula 1 world is abuzz with speculation as Alpine, the French racing team backed by Renault, faces a pivotal moment in its history. Rumors of a potential sale of the team, coupled with an uncertain future for young Argentine driver Franco Colapinto, have sent shockwaves through the paddock. With Renault’s stock plummeting and the departure of key leadership, the team’s trajectory hangs in the balance. Could this be the end of Alpine as we know it, or a strategic pivot toward a brighter future? Let’s dive into the unfolding drama at Enstone.

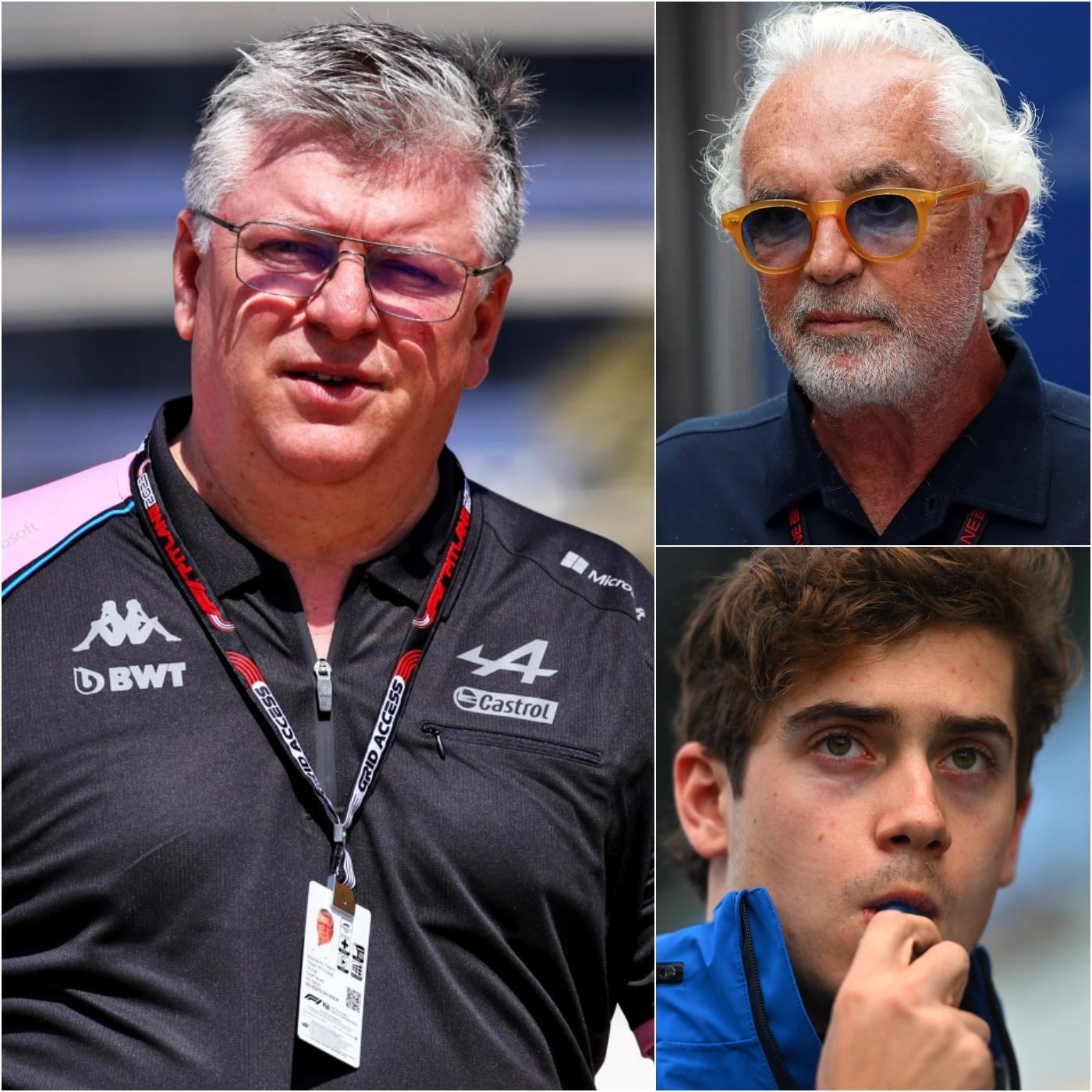

The whispers of a possible sale have grown louder in recent weeks, fueled by reports that Renault, Alpine’s parent company, rejected a staggering $1.2 billion offer for the team. European media outlets suggest that a Chinese conglomerate may be behind the bid, eyeing both the team and the Alpine brand itself. This comes at a time when Renault is grappling with financial pressures, with its shares taking a significant hit in recent days. The decision to halt in-house engine production by the end of 2025, opting instead to become a Mercedes engine customer in 2026, is expected to save the company approximately $100 million. Flavio Briatore, Alpine’s executive advisor, explained the rationale: “In Renault, we have to pay 250 million euros additional for the engines. I run a publicly listed company; I have to make rational decisions every day.” This shift, while financially prudent, signals a strategic retreat from Renault’s storied engine-making legacy in Formula 1.

Alpine’s on-track performance has been lackluster, adding fuel to the fire of uncertainty. The team currently languishes at the bottom of the Constructors’ Championship in 2025, a stark contrast to their surprise double podium in São Paulo last year, which propelled them to sixth place. The A525 chassis, carried over from 2024 with minimal updates, has struggled with reliability and competitiveness. The team’s focus is firmly on 2026, when new regulations promise a reset in Formula 1’s competitive landscape. However, this long-term vision comes at a cost. As Briatore noted, “We have a plan. Luca supported it. His departure won’t stop us.” Yet, the lack of development on the current car has left drivers like Pierre Gasly and Franco Colapinto fighting an uphill battle.

Franco Colapinto, the 22-year-old Argentine sensation, finds himself at the heart of this storm. His arrival at Alpine, facilitated by a $20 million deal orchestrated by Briatore to secure a five-year loan from Williams, was hailed as a coup. Briatore, known for his keen eye for talent, praised Colapinto: “He’s fast. He’s a very, very good driver with some experience. We believe in Franco, and he’s one of our most important assets for the future.” Despite this endorsement, Colapinto’s position is far from secure. Since joining the team in Imola, he has yet to score points, hampered by the A525’s lack of pace and mechanical issues, such as a transmission failure at Silverstone that forced him to retire. Adding to the pressure, rumors swirled about a potential replacement by veterans like Valtteri Bottas or Sergio Pérez, though Renault Argentina CEO Pablo Sibilla recently dispelled these concerns, stating, “Franco will finish the championship. The five-race thing was misunderstood; Flavio said, ‘Forget the five races, it’s done.’”

The departure of Renault Group CEO Luca de Meo, who left for luxury conglomerate Kering on July 15, 2025, has further destabilized Alpine. De Meo was a driving force behind the team’s rebranding from Renault to Alpine in 2021, aiming to elevate the brand’s sporting pedigree. His exit, coupled with the absence of a named successor, has raised questions about the team’s direction. Pierre Gasly, Alpine’s lead driver, reflected on De Meo’s impact: “I’ve always had a good relationship with Luca. He brought me into the team. It’s sad to see him go, but I’m sure he had good reasons.” Gasly remains optimistic, noting, “There’s a lot of positive things happening in the factory. We need to keep this momentum for 2026.”

The financial landscape adds another layer of complexity. In 2023, Renault sold a 24% stake in Alpine to investors, including Otro Capital and celebrities like Ryan Reynolds, valuing the team at over $800 million. Forbes estimated Alpine’s worth at $1.4 billion that same year, underscoring its commercial appeal. However, the team’s current last-place standing and the projected $30 million drop in prize money from the Constructors’ Championship could strain resources further. The decision to forego engine development and focus on 2026 aligns with industry trends, as teams prepare for new regulations that will emphasize hybrid power and sustainable fuels. As one insider remarked, “The 2026 reset is like 2009 with Brawn GP. Whoever nails the new rules could dominate.”

Colapinto’s plight is emblematic of Alpine’s broader challenges. Despite showing flashes of brilliance—matching Gasly’s pace in Austria despite car damage—he’s been hampered by a lack of pre-season testing and an underperforming car. His engineer, Stuart Barlow, publicly apologized after a poor showing in Spain, highlighting the team’s commitment to supporting him. Colapinto’s resilience shines through, as he navigates a team in transition while facing intense media scrutiny. Briatore dismissed rumors of his exit, stating, “Franco is part of the team. The press publishes a lot of rubbish.” Yet, with reserve drivers like Paul Aron and Ryo Hirakawa waiting in the wings, the pressure is on for Colapinto to deliver.

The potential sale of Alpine could reshape the Formula 1 grid. A Chinese buyer could bring fresh investment, but it risks alienating fans who cherish Alpine’s French heritage. Alternatively, the team could follow McLaren’s model, leveraging Mercedes engines to climb the ranks while maintaining its identity. The next few weeks will be critical, as Renault’s board, led by Jean-Dominique Senard, searches for a new CEO. Names like Denis Le Vot of Dacia and Stellantis’ Maxime Picat are in contention, each likely to influence Alpine’s fate.

For Colapinto, the immediate focus is the upcoming Belgian Grand Prix at Spa-Francorchamps, a track where his talent could shine if the A525 holds up. His journey from Williams to Alpine has captivated fans, particularly in Argentina, where his popularity has sparked interest in bringing Alpine-branded road cars, like the A110 and A290, to the market. Pablo Sibilla hinted at this possibility: “We’re seriously analyzing bringing Alpine to Argentina. Franco’s arrival has created huge excitement.”

As Alpine navigates this crisis, the stakes couldn’t be higher. Will Renault sell the team, or will it double down on its Formula 1 ambitions? Can Colapinto defy the odds and secure his place in the sport’s elite? The answers lie in the weeks ahead, as the Formula 1 world watches with bated breath. One thing is certain: the drama at Alpine is far from over, and its resolution will shape the future of the team and its young Argentine star.