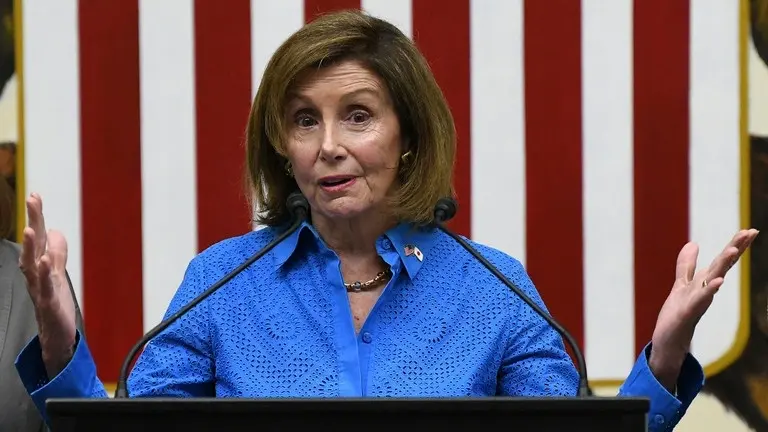

President Donald Trump has repeatedly accused former House Speaker Nancy Pelosi of profiting from insider information, a claim that has stirred controversy and fueled political firestorms. The allegations, often voiced during his 2016-2021 presidency and amplified on platforms like X, suggest Pelosi used her position to make lucrative stock trades, enriching herself and her husband, Paul Pelosi. These charges tap into public distrust of Washington elites, but do they hold water? Let’s unpack the drama, the evidence, and the stakes with a clear lens.

The accusations center on the Pelosis’ wealth, particularly their stock market success. Paul Pelosi, a venture capitalist, has made high-profile trades in tech giants like Apple, Microsoft, and Nvidia, often yielding significant returns. Trump and his allies, including posts on X, have pointed to trades timed suspiciously close to congressional actions—like a 2020 Visa stock purchase before a credit card bill or 2021 tech stock buys before regulatory debates—as proof of insider trading. A viral 2020 claim even suggested Nancy Pelosi’s net worth was $196 million, implying corrupt gains. Trump’s rhetoric, including rally speeches, framed her as a symbol of a “rigged” system.

The reality is murkier. Pelosi’s financial disclosures, required by the 2012 STOCK Act, show her husband’s trades, but no direct evidence links them to classified briefings or legislative moves. For instance, a 2021 PolitiFact analysis of the Nvidia trade found it occurred months before any public regulatory action, undermining claims of insider advantage. Paul Pelosi’s decades-long career as an investor, predating Nancy’s political rise, explains much of their wealth, estimated at $100-$150 million by OpenSecrets in 2020. The $196 million figure is inflated, based on outdated 2010 data that ignored liabilities, as confirmed by USA TODAY.

Still, the optics sting. Pelosi’s defense—that she doesn’t oversee her husband’s trades—hasn’t quelled skepticism, especially when Congress debates bills affecting industries the Pelosis invest in. A 2022 push for stricter congressional trading rules, backed by both parties, gained traction partly due to public outrage over cases like hers. Yet, no investigation has found Pelosi guilty of insider trading. The SEC, which probes such cases, requires proof of non-public information use, a high bar unmet here. A 2023 X post claiming she “dodged” charges lacks credible sourcing.

Trump’s accusations resonate because they tap into real frustration: many Americans see politicians as untouchable. Pelosi’s wealth, even if legally earned, fuels that narrative. But without concrete evidence, the charges remain speculative, more political weapon than proven fact. The debate has sparked reform—Congress now faces pressure to ban members’ stock trading altogether. For now, the Pelosis’ trades are legal, and Nancy’s legacy as a powerful speaker overshadows unproven claims. Still, in a polarized era, Trump’s words keep the suspicion alive, a reminder that trust in leaders is as fragile as ever.