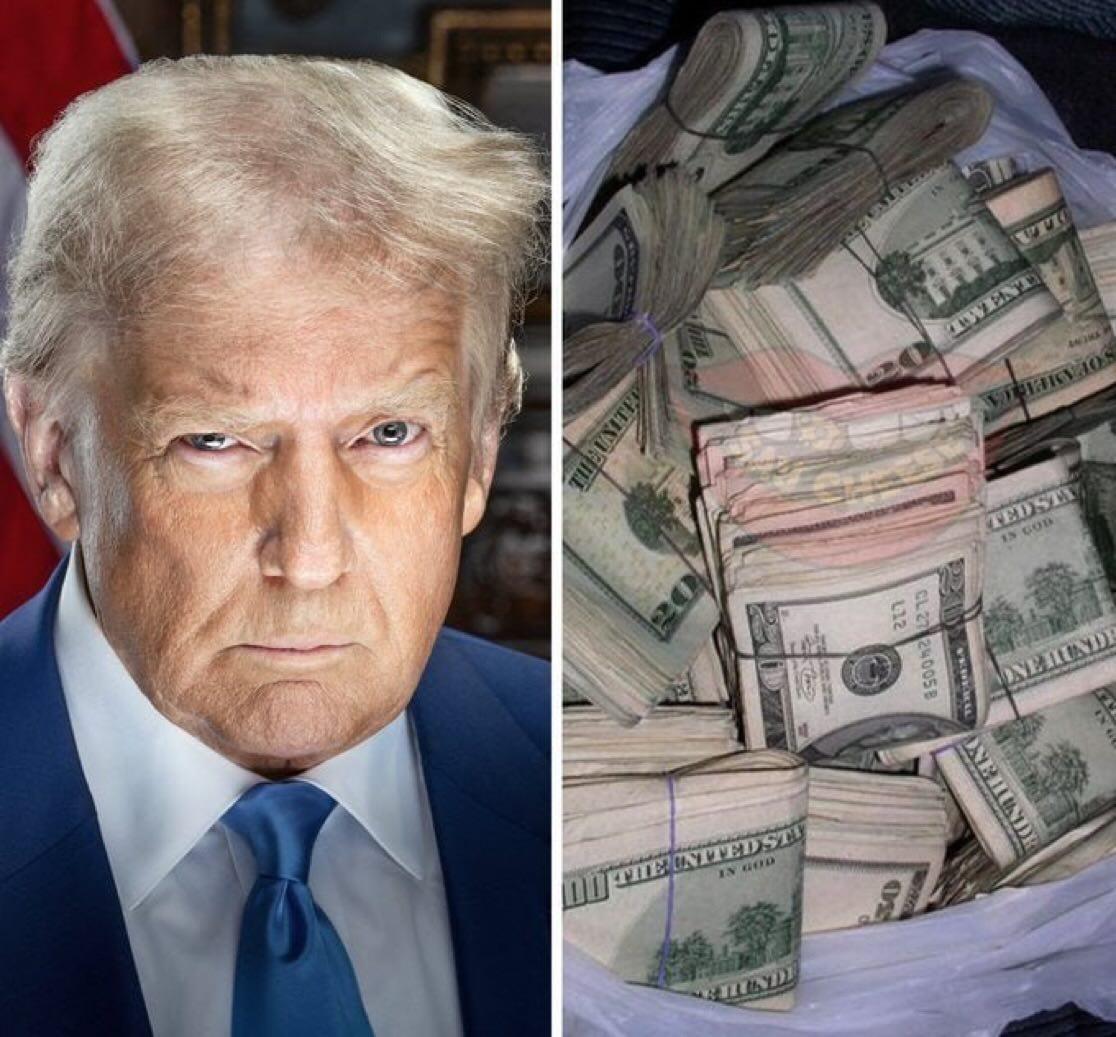

Washington, D.C. – In a stunning announcement, President Donald Trump has unveiled an ambitious plan to eliminate federal income taxes for individuals earning less than $200,000 annually. The proposal, shared via Truth Social on April 27, 2025, has sparked intense debate over its feasibility and economic implications for the United States. Trump claims that tariffs on imported goods would generate sufficient revenue to offset the removal of income taxes, providing direct relief to middle-class and working-class households. However, economists have quickly raised concerns about the practicality of this bold policy.

According to Trump’s post, the policy targets roughly 85% of American households, who earn under $200,000 per year, based on 2023 Census Bureau data. Trump argues that tariffs, particularly on imports from countries like China, could create a “financial windfall” substantial enough to replace income tax revenue. He described the plan as an “economic revolution” to free Americans from what he called “financial slavery.” The proposal aligns with Trump’s long-standing advocacy for protectionist trade policies and tax cuts, which he claims will boost domestic growth and reduce reliance on foreign goods.

Economists, however, are skeptical. Experts like Erica York and Huaqun Li from the Tax Foundation note that tariff revenue currently accounts for a fraction of federal income tax revenue, with the latter generating over 27 times more than tariffs. They estimate that Trump’s existing and proposed tariffs for 2025 would yield approximately $167 billion in new federal tax revenue, covering less than 25% of the cost of eliminating income taxes for those earning under $200,000. This shortfall raises significant questions about how the remaining budget gap would be addressed without ballooning the national deficit.

Supporters of Trump’s plan, including figures like Senator Bernie Moreno, argue that removing income taxes would stimulate consumer spending and drive economic growth. They contend that the policy would put more money directly into the pockets of working Americans, fostering financial independence. Conversely, critics warn that higher tariffs could increase the cost of imported goods, disproportionately harming lower- and middle-income households—the very groups Trump aims to benefit. Jason Furman, a former economic advisor to President Barack Obama, estimates that a typical household could face increased costs of $1,500 to $2,000 annually due to higher tariffs, potentially offsetting any tax savings.

The proposal has also reignited discussions about wealth inequality. Critics argue that eliminating income taxes for those under $200,000 while maintaining them for higher earners could shift the tax burden upward, but without addressing loopholes that benefit the ultra-wealthy. Others see it as a populist move to appeal to Trump’s base ahead of future political battles. As Congress prepares to debate the plan, its passage remains uncertain, with analysts predicting fierce opposition from both fiscal conservatives and progressive lawmakers.

At 500 words, this proposal marks a pivotal moment in Trump’s economic agenda, promising relief for millions but raising complex questions about funding and long-term impacts. The nation awaits further details as the debate unfolds.