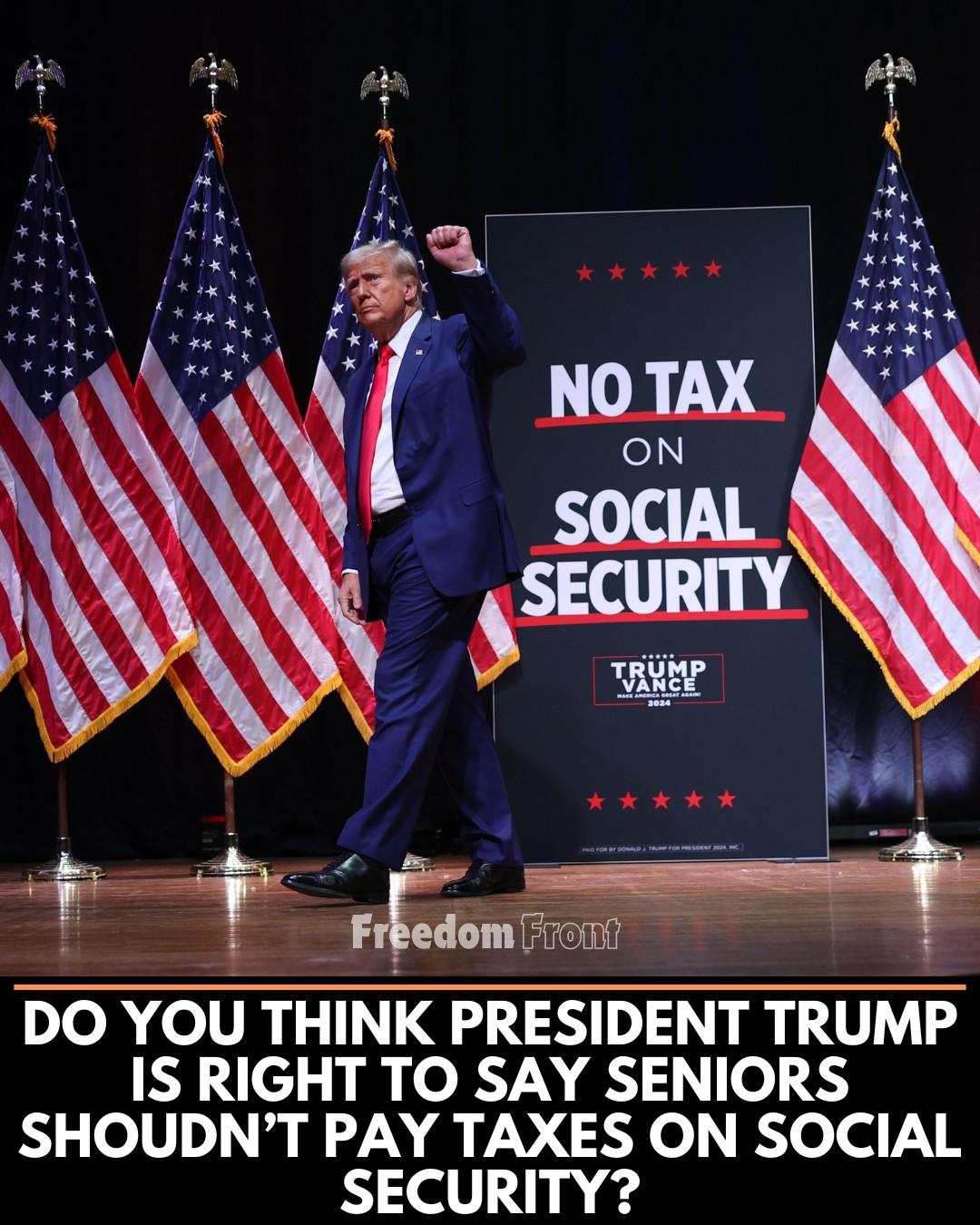

In a bold move that has electrified political discourse, President Donald Trump has reignited debates over taxation with a striking proposal: eliminating taxes on Social Security benefits for seniors. The idea, prominently displayed on campaign signage reading “NO TAX ON SOCIAL SECURITY” alongside his 2024 running mate JD Vance, has sparked a firestorm of reactions across the nation. As Trump strides confidently before a backdrop of American flags, his stance has divided opinions, with supporters hailing it as a lifeline for retirees and critics warning of dire economic consequences.

The proposal centers on relieving seniors of the federal income tax burden on their Social Security payments, a policy that currently affects higher-income retirees. Trump’s campaign frames this as a fulfillment of his promise to protect the elderly, arguing that seniors who have worked hard their entire lives deserve to keep every dollar of their benefits. “It’s about fairness,” a campaign spokesperson declared. “Seniors shouldn’t be penalized for their years of contribution.” The FreedomFront poll question plastered across the image—“Do you think President Trump is right to say seniors shouldn’t pay taxes on Social Security?”—has become a rallying cry for his base, with many flooding social media platforms like Threads to voice their support.

Yet, the plan has met fierce resistance from economists and opposition figures. Critics argue that removing this tax revenue—estimated at billions annually—could destabilize the already strained Social Security system. “This is a short-term win that could lead to long-term collapse,” warned financial analyst Sarah Mitchell. “Without that income, the trust fund could dry up faster, leaving future generations at risk.” Others point out that the tax primarily affects wealthier retirees, suggesting the policy benefits a select group rather than the broader senior population. On Threads, these concerns have fueled heated debates, with users posting charts and data to challenge the proposal’s viability.

The policy’s implications extend beyond economics into the political arena. Democrats have seized on the idea as a campaign issue, accusing Trump of pandering to his base while ignoring systemic fixes for Social Security’s funding shortfall. “This is a gimmick, not a solution,” tweeted a prominent Democratic senator, sparking a cascade of replies. Meanwhile, conservative voices on Threads have countered with enthusiasm, sharing testimonials from seniors who say the tax cut would ease their financial burdens. “My mom struggles every month—Trump gets it,” one user wrote, igniting a thread with thousands of interactions.

Public opinion appears split, with the FreedomFront poll amplifying the divide. Supporters argue it’s a moral imperative, citing the rising cost of living and healthcare for seniors. “They’ve earned this break,” posted a retiree on Threads, earning widespread agreement. Opponents, however, fear it could set a precedent for broader tax cuts favoring the wealthy, with one user quipping, “Next, he’ll say billionaires shouldn’t pay taxes either.” The lack of detailed policy rollout has only intensified speculation, with some suggesting Trump might unveil a refined plan closer to the 2024 election to maximize political impact.

Internationally, the proposal has drawn mixed reactions. Some allies praise it as a bold move to support aging populations, while others caution it could signal a shift toward unsustainable fiscal policies. Domestically, advocacy groups for seniors are divided—some cheer the tax relief, while others worry about the program’s long-term health. “We need sustainability, not soundbites,” said a leader from AARP, adding fuel to the online firestorm.

On Threads, the topic has exploded into a trending saga. Memes depicting Trump as a senior savior clash with satirical takes labeling the plan a “senior giveaway.” Viral videos of campaign rallies, like the one in the image, have amplified the narrative, with users debating the feasibility and fairness in real-time. The algorithm-driven nature of the platform ensures that every strong opinion boosts visibility, making this a hotbed for engagement.

The debate also touches on broader themes of governance and trust. Trump’s history of bold promises—like tax cuts during his first term—looms large, with supporters betting on his delivery and skeptics awaiting the fine print. If implemented, the policy could reshape retirement planning and federal budgeting, potentially altering the social contract for millions. As of now, with the election looming and no official legislation tabled, the proposal remains a provocative talking point.

With opinions raging and the clock ticking toward November 2024, all eyes are on Trump’s next steps. Will he push this through as a signature policy, or will it fade as a campaign flourish? The uncertainty keeps the conversation alive, ensuring that this bold tax proposal will dominate discussions for months to come. One thing is clear: the battle over Social Security taxes has only just begun, and the outcome could redefine America’s approach to its aging population.